Michael Greeson | Founder & Principal Analyst | July 11, 2023

So why are Zaslav et al. only now considering inter-network bundles in earnest? There are several at play, some market-driven, others consumer-driven.

Demand Saturation

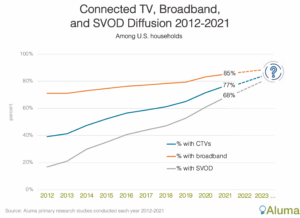

I’ve written extensively about the wave of saturation mature SVOD services are now experiencing. Aluma warned clients of its imminent arrival well before demand for Netflix softened. The chart below is from 2021 and illustrates how broadband diffusion sets the ceiling for penetration of related products and services such as connected TVs (CTVs) and SVOD services. This, combined with declining interest among non-subscribers to sign up for SVOD services, suggested SVOD’s headroom was nearing its demand asymptote.

The forecast turned out to be prescient. In 1Q.22, Netflix reported its first significant loss of domestic subscribers in more than a decade, sending Wall Street and Hollywood scrambling to make sense of what had happened. The so-called “Great Netflix Correction” and the associated revenue optimization measures have changed the rules of the SVOD industry … something Aluma clients expected long before it happened.

Blowing Up The Bundle

Since the early days of cable, pay-TV subscribers have been required to use a proprietary set-top box (STB) that connected to an operator’s private network. The company-owned boxes were the only gateway through which subscribers could access content, and the company-owned network among few that could deliver such services to the home. This gave pay-TV operators extraordinary control over the home video experience and provided users a wide assortment of channels for one monthly fee.

When streaming video finally reached the television some 16 years ago, legacy pay TV faced its first serious challenge. Unlike pay TV, streaming video services required no proprietary hardware, no contract, and were available à la carte. No longer did consumers have to pay for 500 channels but use only 20. It was no surprise that the value proposition proved compelling to both consumers and SVOD purveyors.

But as many are discovering, there is a downside to SVOD users having hundreds of siloed apps from which to choose. With demand saturating, it’s time service providers address these pain points.

Choice, Fragmentation, And Fatigue

The freedom of choice is a driving force in capitalist economies. But it tends to work best when the number of options are manageable. Excessive choice can be overwhelming, so much that it undermines the quality of experience.

In the words of psychologist Barry Schwartz in 2004:

“Learning to choose is hard. Learning to choose well is harder. And learning to choose well in a world of unlimited possibilities is harder still, perhaps too hard.”

It’s a deceptively simple thesis and of growing relevance to today’s SVOD providers.

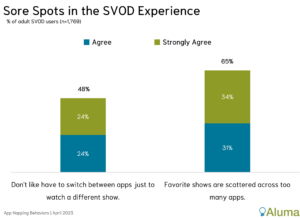

Aluma’s research has long found consumers are overwhelmed by the number of options they have for streaming video services. What’s different is that we are beginning seeing the consequences of excessive choice in the form of app fatigue. Recent Aluma research found two-thirds of adult SVOD users are unhappy their favorite shows are scattered across too many apps. As well, half are frustrated with having to switch between apps just to watch a different show. Half of both groups consider these problems to be strongly detrimental to the quality of experience.

These pain points were more tolerable when the cost of SVOD services was relatively low compared with pay TV. But the retail prices of SVOD services are increasing at rates above inflation, causing consumers to be less understanding about fragmented viewing experiences. Add to this the hassle of separate payments, logins, and customer service departments and you have a growing concern that needs to be addressed.

We are at the point where the combination of higher costs and user fatigue not only dampen demand for SVOD services but encourage app hopping—that is, consumers regularly using SVOD services for a short period of time, cancelling, then signing up for another service. Thus, the stage is set for a new iteration of pay TV—not the MVPD model we know and loathe, but inter-network app bundles that incorporate key elements of it.

Internetwork Bundles

In 2018, I introduced the concept of ‘Pay TV 3.0’ (PTV 3.0) to describe the next generation of SVOD aggregators, who would offer a single bill for all of one’s SVOD services, a single point of service management, unified search & recommendations, and one-year contracts, among other features. Subscribers would receive a discount for buying multiple services in exchange for a one-year commitment, thus guaranteeing operators something they rarely have—a year of guaranteed revenue.

The most viable candidates for 3.0 were and remain large tech-media firms with proprietary aggregation platforms, including Alphabet, Amazon, Apple, Comcast, and Roku. Each of the five offer branded hardware and their own SVOD service or TV network, a combination that conferred strong competitive advantage. With a presence in each link of the home video value chain—content, platform, devices, and services—these companies were perfect contenders for PTV 3.0 bundles. That doesn’t mean other aggregation schemes (e.g., Verizon’s +Play) won’t work, only that it will be more challenging for those without the breadth of ownership that large tech-media companies enjoy.

As with many of my prognostications during the last 20+ years, it took the industry several years to get buy in from the industry. That changed in May 2023, when WBD CEO David Zaslav predicted a wave of consolidation in the SVOD space not from mergers and acquisitions but from … wait for it … bundling the top SVOD services into a single offering.

“For me, it seems very clear that if we were to package … in each market the number one, two, or three products for a specific price, it would probably reduce churn. If we don’t do it ourselves, I think it’ll be done for us.”

David Zaslav, WBD CEO, May 2023

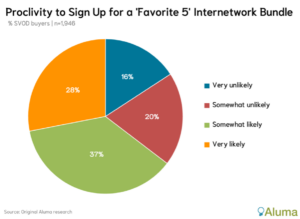

Unfortunately, he shared no specifics, so it is unclear whether his concept includes all aspects of a PTV 3.0 solution. It is likely Zaslav has in mind something less, but his comments portend an inter-network bundle, in which Aluma (and TDG) research has long found strong consumer interest, even with a 1-year contract required. At a cost-averaged $50 per month, two-thirds of adult SVOD buyers are to varying degrees likely to sign up for a bundle of their five favorite services, 28% very likely.

When asked which five services they’d include in this inter-network bundle, Netflix topped the list (selected by 81%), followed by Prime Video (60%), Hulu (55%), Disney+ (50%), and MAX (47%).

While service providers lose a bit of profit, they gain a guaranteed 12-month contract. And while consumers lose a bit of flexibility, they gain discount pricing and other benefits. Of course, à la carte will still make more sense to some, but for most others an internetwork bundle would be more compelling from a cost point of view and certainly more convenient (the first pain point mentioned above).

As well, PTV 3.0 purveyors can include periodic realignment—that is, allow subscribers to change their five apps during the contract, say, at six months tenure. While this would reduce subscription periods to six months versus one year, it would discourage app hopping (the second pain point). This could be done at the end of the one-year contract, but it might not prevent app hopping.

The Future is Now

There are myriad options to fine tune PTV 3.0 bundles, limited only by the imagination of strategic marketers. But simplifying the entire SVOD experience, not just the use of one’s app, should be near the top of strategic priorities. As Zaslav said, SVOD service owners can do it themselves or some third-party will do it for them.

To learn more about Aluma’s research, please contact us at info@alumainsights.com.