Amazon Prime and Walmart+, subscription streaming video services play an important role in how members perceive the bundle’s value. This according to a new report from home-video insights firm, Aluma, who recently published a new report on the subject, The Role of Video in Retail Membership Bundles.

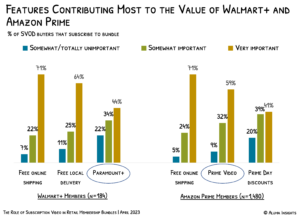

Prime Video is the second most-important feature of Amazon’s bundle, just ahead of Prime Day discounts. Among Walmart+ members, free local delivery is the second most-important feature, followed by Paramount+, which the company added to its RMB in August 2022.

“Both Amazon and Walmart are leaning into streaming video services to boost the value of membership, and for good reason,” said Douglas Montgomery, senior analyst at Aluma. “Prime Video benefits from being baked into by far the largest retail membership bundle, which currently serves over 70 million US SVOD households, eight times the reach of Walmart+. While Paramount+ is a good first step for Walmart’s membership bundle, it needs to be followed up with similar additions. Unlike Amazon, Walmart doesn’t offer its own SVOD service, so competitive providers may be more comfortable bundling with it.”

As if on cue, Walmart last week added six seasons of ad-free shows from Pluto TV to its bundle, with each lineup pre-selected by Walmart+ members and rotated monthly. Having a revolving lineup of shows provides the company an opportunity to test a variety of content types to see what resonates best with their membership, which should help reduce churn and optimize content spending.

While the RMB space is at the moment a two-way battle between Amazon and Walmart, customer loyalty is critical to all retailers. Montgomery recommends larger brands who may have tried but failed (e.g., Target Ticket, Best Buy/Cinema Now) to reconsider the idea of adding subscription streaming video services to their loyalty programs. With SVOD now used in roughly 85% of US households, and numerous services with over 20 million paid subscribers, the context differs greatly from even five years ago. There are more options for content partners, plus most of the top 10 SVOD services are experiencing or will soon experience domestic saturation, making them more amenable to such partnerships.

Target’s free loyalty program, Target Circle, already includes a free 6-month free trial of Apple TV+. The retailer should leverage this relationship to build a fee-based membership bundle featuring one or more subscription streaming video services. Best Buy’s paid membership program currently features a litany of attractive benefits, but it could benefit from adding a variety of personal and home media services, including SVOD. This would play well with the company’s home media focus and provide a meaningful benefit for members.

Montgomery adds that we may one day see retail membership bundlers merge with premium video providers in order to better compete with Amazon. As the technology for shoppable television, ad-targeting, etc. improves, the range of options available to retailers expands, including ad partnerships, product placements, and branded offerings to provide new revenue and exposure for its partners.

Aluma surveyed adults that purchase home video services for their households and that pay for at least one SVOD service regarding their use of Amazon Plus and Walmart+ memberships. Since both programs are first and foremost about online shopping, it is highly likely that their members watch streaming video on TV. Thus, Aluma believes how SVOD users perceive the importance of various bundle features is a reliable guide to non-SVOD users, as well.

Aluma’s new report, The Role of Video in Retail Membership Bundles, is now available to the public. The report discusses original research on the importance of 11 Amazon Prime features and eight Walmart+ features, and includes Mr. Montgomery’s strategic insights on the state of RMB marketplace and what the road ahead looks like.

For more information about the report or to arrange purchase, contact us at sales@alumainsights.com.

About Aluma’s Original SVOD Research

Aluma recently surveyed nearly 2,000 US household decision-makers that pay for at least one SVOD service on a variety of topics, including the number of SVOD services paid for versus used, monthly spending, service value, proclivity to cancel, interest in inter-network SVOD bundles, TV viewing by service and device type, and much more.

About Aluma Insights

Aluma provides actionable insights to video creators, distributors, and OEMs looking to master the opportunities & challenges of the connected TV ecosystem. To inquire further about Aluma’s research, please contact us at info@alumainsights.com.

To inquire further about Aluma’s consumer video research, please contact us at info@alumainsights.com.